Get This Report about Hard Money Atlanta

Wiki Article

The 2-Minute Rule for Hard Money Atlanta

Table of ContentsUnknown Facts About Hard Money AtlantaAn Unbiased View of Hard Money AtlantaThe Greatest Guide To Hard Money AtlantaAn Unbiased View of Hard Money Atlanta

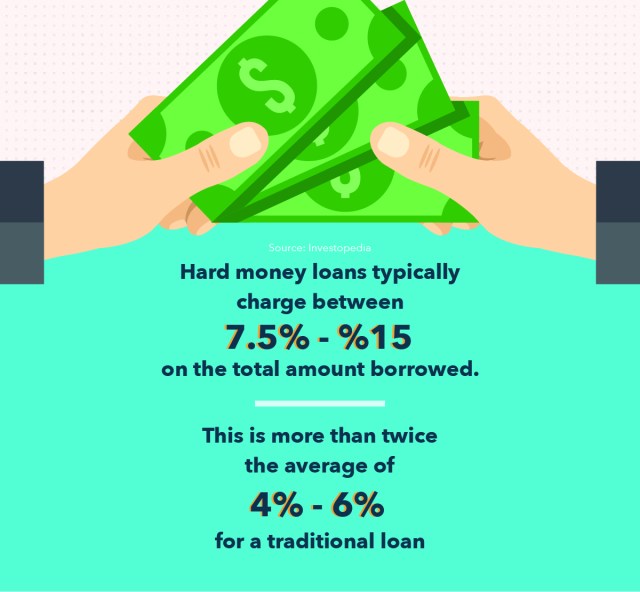

By comparison, rate of interest on difficult cash finances start at 6. 25% but can go a lot higher based on your location and also the residence's LTV. There are other costs to maintain in mind, also. Hard money loan providers typically charge factors on your financing, often referred to as origination costs. The points cover the administrative costs of the loan.

Points are usually 2% to 3% of the finance amount. For instance, 3 factors on a $200,000 loan would certainly be 3%, or $6,000. You might have to pay more factors if your funding has a higher LTV or if there are multiple brokers associated with the purchase. Some loan providers charge just factors and also no various other charges, others have additional costs such as underwriting charges.

All About Hard Money Atlanta

You can expect to pay anywhere from $500 to $2,500 in underwriting costs. Some tough cash lenders additionally bill early repayment penalties, as they make their cash off the rate of interest fees you pay them. That implies if you repay the lending early, you may need to pay an extra charge, including to the loan's price.This indicates you're a lot more most likely to be provided funding than if you made an application for a standard home loan with a doubtful or thin credit rating background. hard money atlanta. If you require cash quickly for improvements to flip a residence for profit, a hard money finance can offer you the cash you need without the hassle and also paperwork of a traditional mortgage.

It's a method capitalists make use of to acquire financial investments such as rental buildings without making use of a great deal of their very own assets, and difficult cash can be beneficial in these circumstances. Although hard cash financings can be useful genuine estate capitalists, they ought to be made use of with care particularly if you're a novice to property investing.

With shorter settlement terms, your regular useful site monthly settlements will certainly be far much more pricey than with a routine mortgage. Ultimately, if you back-pedal your car loan settlements with a hard money lending institution, the repercussions can be severe. Some fundings are personally ensured so it can harm your credit score. As well as because the loan is secured by the residential or commercial property in you can try these out inquiry, the lender can take property and foreclose on the property because it functions as security.

Hard Money Atlanta Can Be Fun For Anyone

To find a trustworthy lending institution, speak to relied on real estate agents or home loan brokers. They might be able to refer you to lending institutions they've worked with in the past. Tough money lenders also often participate in investor conferences to ensure that can be a great area to attach with loan providers near you. hard money atlanta.Equity is the worth of the home minus what you still owe on the mortgage. The underwriting for residence equity loans also takes your credit scores history and also revenue right into account so they have a tendency to have lower interest prices and also longer repayment periods.

When it pertains to moneying their next bargain, investor as well as business owners are privy to several lending alternatives essentially produced realty. Each includes certain demands to access, as well as if utilized appropriately, can be of significant benefit to capitalists. One of these loaning kinds is hard money loaning. hard money atlanta.

It can likewise be termed an asset-based loan or a STABBL finance (short-term asset-backed bridge funding) or a swing loan. These are originated from its characteristic temporary nature and also the requirement for tangible, physical security, typically in the type of realty home. A difficult money car loan is a finance type that is backed by or protected using a real building.

The Facts About Hard Money Atlanta Uncovered

They are considered short-term bridge fundings and also the major usage situation for difficult cash finances is in realty transactions. They are thought about a "difficult" cash loan due to the fact that of the physical asset the genuine estate residential or commercial property called for to protect the finance. In the occasion that a customer defaults on the car loan, the loan provider books the right to presume ownership of the property in order to recoup the funding amount.In the exact same vein, the non-conforming nature manages the lending institutions a possibility to determine on their very own particular needs. As a result, needs may differ substantially from lender to lending institution. If you are seeking a loan for the very first time, the approval procedure could be relatively rigorous and you might be required to offer added information.

This is why they are generally accessed by property entrepreneurs that would generally require fast funding in order to click for source not miss out on out on warm opportunities. In addition, the lending institution mostly thinks about the worth of the asset or property to be bought as opposed to the debtor's individual money history such as credit rating or earnings.

A traditional or financial institution lending may use up to 45 days to shut while a difficult money funding can be shut in 7 to 10 days, sometimes faster. The convenience and also speed that difficult money loans offer remain a major driving force for why genuine estate financiers select to use them.

Report this wiki page